What is Surcharge?

How to compensate for the cost of accepting cards with higher fees:

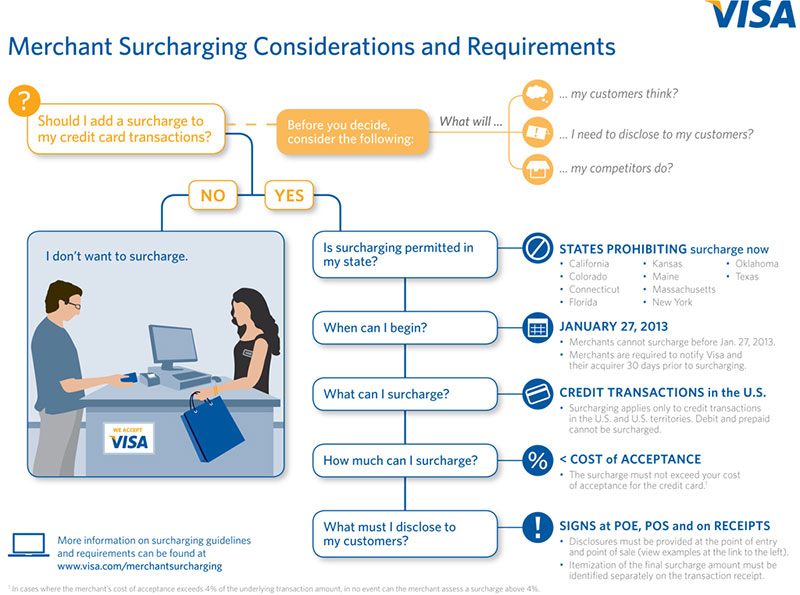

As part of a recent settlement in the United States District Court for the Eastern District of New York, card companies are required to implement certain International Operating Regulation rule changes, including the ability for merchants in the U.S. and U.S. territories to surchargecertain credit card transactions beginning January 27, 2013.

Merchants who choose to surcharge will be required to follow certain requirements, including disclosure of surcharge practices to customers at the store entry point and at the point of sale. The following information and resources are available to assist merchants who opt to surcharge in preparing for these changes:

Below are links to pages outlining surcharge rules for each card type:

Visa

Mastercard

Discover (pdf – see page 18, section 2.5)

Amex (pdf – see page 14, section 3.2)

Should I surcharge my customers?

Before choosing to surcharge, U.S. merchants may want to consider a number of factors, including:

* the potential impact on your customers’ experience

* what your competitors might be doing

* what information must be disclosed to your customers, and how

* cost of credit cards and other forms of payment

Which cards cost more to accept?

Merchants pay a higher percent on any card that pays kickbacks to the cardholder in the form of points, miles, cash back, etc. These cards are typically marked as rewards or business cards on the front of the card (see examples below).

As a merchant you are allowed to surcharge specific card types and card brands. This allows you to charge only cards that cost you a higher percentage. However, at this time there is no automatic means of doing so. Disclosure at the POS must detail the cards that will be surcharged.